Small businesses crumble under hefty taxes every year. 🪨

Sky-high taxes shrink profits and stifle growth. North Carolina offers a lifeline with its low-tax environment. This shift can mean more cash in hand and expansive growth for your business.

Learn the steps to leverage North Carolina’s tax advantages for your business today.

1) Unbeatable Corporate Tax Rate

At 2.5%, North Carolina boasts the lowest corporate tax rate in the entire nation.

Imagine keeping more of your hard-earned money in the business, rather than seeing it disappear into the government’s coffers. This low rate presents an incredible opportunity to reinvest those savings back into your company, fueling growth and expansion like never before. North Carolina understands that small businesses are the backbone of the economy, and they’ve made it their mission to create an environment where entrepreneurs can thrive.

By keeping corporate taxes at a bare minimum, they’re giving you the freedom to allocate those funds towards hiring top talent, investing in cutting-edge technology, or exploring new markets.

Table 1: Corporate Tax Rates Comparison

| State | Corporate Tax Rate (%) |

|---|---|

| North Carolina | 2.5 |

| New Jersey | 6.5 |

| Pennsylvania | 8.49 |

| Iowa | 7.1 |

| Arkansas | 1 |

| North Dakota | 1.41 |

According to a study by the Tax Foundation, a 1% reduction in corporate tax rates can lead to a 3.3% increase in economic growth.

That’s a staggering figure, and it highlights just how much of an impact a low corporate tax rate can have on your bottom line. Whether you’re a startup or an established business, every penny counts, and North Carolina’s commitment to keeping taxes low means more of those pennies stay in your pocket.

🗣️ “The size of a corporation does not necessarily relate to the income levels of its owners. This underscores the benefits of a single-rate system like that of North Carolina, which minimizes incentives for tax avoidance strategies.” – Jeffrey Kwall, a professor of law at Loyola University Chicago School of Law

2) Attractive Personal Income Tax

A flat rate of 4.75% is hard to ignore when it comes to North Carolina’s personal income tax.

More money in your pocket translates to greater financial freedom and security for you and your family. Just think about what you could do with those extra savings! Perhaps you’ve been dreaming of taking an extended vacation to recharge your batteries and come back refreshed. Or maybe you want to invest more into your retirement fund to ensure a comfortable future down the line.

You could even use that extra disposable income to splurge on experiences and purchases that significantly improve your quality of life.

Table 2: Personal Income Tax Rates for Selected States

| State | Personal Income Tax Rate (%) |

|---|---|

| North Carolina | 4.75 |

| New York | 6.5 |

| California | 8.84 |

| New Jersey | 6.5 |

| Texas | No Personal Income Tax |

No matter how you choose to allocate that money, one thing is clear – a lower personal income tax burden means keeping more of what you’ve worked so hard to earn.

It’s an enticing proposition for any small business owner looking to optimize their finances and unlock new possibilities. What’s more, North Carolina’s flat tax rate provides a refreshing simplicity compared to the convoluted, multi-bracket systems found in many other states. No more poring over complex tax tables or fretting about which deductions you qualify for.

Just a straightforward, easy-to-understand rate that makes budgeting and financial planning a breeze.

3) Industry-Specific Tax Incentives

North Carolina isn’t content with just offering low corporate and personal income taxes – the state goes the extra mile by providing targeted tax incentives tailored to specific industries.

This strategic approach demonstrates a keen understanding that different sectors have unique needs and challenges. For manufacturers, North Carolina offers a tantalizing array of sales and use tax exemptions. From the machinery and equipment used on the production line to the raw materials that go into your products, these exemptions can translate into substantial cost savings. Even the electricity, fuel, and natural gas powering your facilities are exempt from sales tax. But what about those all-important inventories that keep your operations running smoothly? North Carolina has you covered there too, with exemptions on inventories of goods for manufacturing.

This comprehensive suite of tax breaks empowers manufacturers to reinvest those savings into expanding their operations, developing new product lines, or exploring innovative processes.

Table 3: Industry-Specific Tax Incentives in North Carolina

| Industry | Type of Incentive | Description |

|---|---|---|

| Manufacturing | Sales and Use Tax Exemptions | Exemptions on machinery, equipment, raw materials |

| Technology | Tax Credits | For software publishing, data processing |

| Renewable Energy | Grants and Tax Credits | Support for green initiatives |

The advantages don’t stop at manufacturing, however.

North Carolina’s commitment to economic growth extends to sectors like technology, renewable energy, and even film production. Each industry has its own unique set of incentives, carefully crafted to nurture and support businesses within that space. Take the technology sector, for instance. Companies engaged in software publishing, data processing, or certain service-related industries may qualify for valuable tax credits.

These incentives not only attract tech firms to the state but also foster an environment conducive to innovation and growth.

🗣️ “Corporate income taxes account for an average of just 3.38 percent of state tax collections and 2.24 percent of state general revenue, highlighting the importance of targeted incentives for industry-specific growth” – World Population Review

4) A Thriving Business Community

While the financial advantages of relocating to North Carolina are undeniably appealing, the state offers something even more valuable: a thriving, interconnected business community that can open doors to new opportunities and collaborations.

As a small business owner, you know that success isn’t just about crunching numbers and cutting costs – it’s also about forging relationships and staying ahead of the curve. In North Carolina, you’ll find yourself surrounded by like-minded entrepreneurs, forward-thinkers, and industry leaders who can provide fresh perspectives and invaluable insights. Imagine the power of networking with individuals who share your passion for innovation and growth. Perhaps you’ll discover a new supplier that can streamline your operations, or a potential partner with complementary expertise to take your business to new heights.

The connections you make could lead to joint ventures, strategic alliances, or even the next big idea that disrupts your industry.

North Carolina’s business community is vibrant and diverse, spanning industries from technology and healthcare to finance and manufacturing.

This melting pot of talent and expertise creates an environment ripe for cross-pollination of ideas and the exchange of best practices. Moreover, the state is home to a wealth of resources and support systems for small businesses, including incubators, accelerators, and mentorship programs.

These initiatives not only foster entrepreneurship but also provide valuable guidance and resources to help your business navigate the challenges of growth and expansion.

5) A Better Quality of Life

Success is about more than just profit margins and balance sheets.

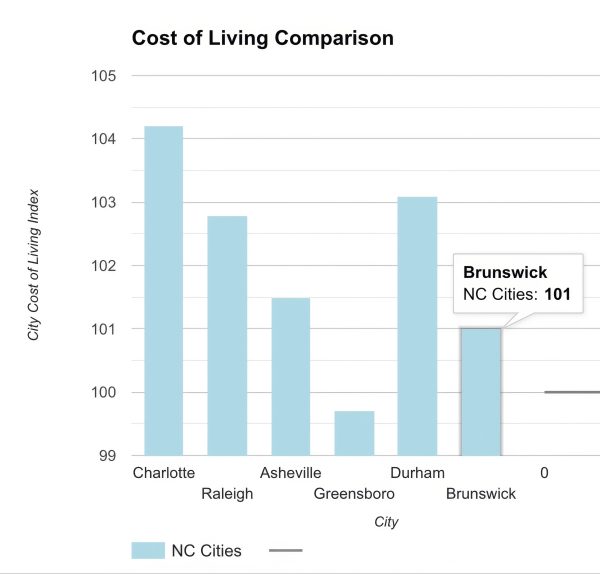

At the end of the day, building a thriving business is about creating a life that you truly love – one where you can strike a harmonious balance between work and personal fulfillment. And in North Carolina, you’ll find a quality of life that rivals any other state. First and foremost, the cost of living in North Carolina is remarkably affordable, especially when compared to larger metropolitan areas. Whether you’re looking to purchase a spacious home or simply enjoy a lower cost of daily expenses, your hard-earned money goes further in this state.

This financial breathing room can alleviate stress and allow you to focus more on growing your business.

But it’s not just about the numbers; North Carolina offers a rich tapestry of natural beauty and cultural vibrancy that can rejuvenate the soul.

From the majestic peaks of the Blue Ridge Mountains to the pristine beaches of the Outer Banks, you’ll find no shortage of opportunities to escape the hustle and bustle of daily life. Imagine spending your weekends hiking through lush forests, casting a line in a tranquil stream, or simply lounging on the sand with a good book. For those who crave a more urban experience, North Carolina boasts vibrant cities like Charlotte, Raleigh, and Asheville, each with its own unique character and charm. These cities offer a wealth of cultural attractions, from world-class museums and performing arts venues to eclectic dining scenes and lively nightlife.

Whether you’re a foodie, an art enthusiast, or simply someone who appreciates the energy of a bustling metropolis, you’ll find plenty to explore and enjoy.

Final Thoughts

The tax burden can break or make a small business.

North Carolina’s tax benefits offer a clear solution. They provide more room for investment and growth. This change can lead your business to new heights.

Adopting these advantages can be your next smart move.

Did you enjoy this article?

We’re passionate about explaining the key tax advantages for small businesses relocating to low-tax states like North Carolina.

Click here to contact Brunswick Business & Industry Development. And feel free to call with any questions you have at (910) 408-1603!